Most of us understand SIPs or Systematic Investment Plans. But, what is ‘Step-Up’ or a ‘Top-Up’ SIP? We know how SIP works, how we gain from disciplined investing, rupee cost averaging, power of compounding etc. But have you ever thought that as per your increase in salary, you can also increase your SIP amount every year? In a normal SIP the investment amount remains the same every month throughout the tenure of the SIP. Meaning, if I start an SIP of Rs.10,000/- today for 10 years I will make a fixed investment of Rs.10,000/- each month for the next 120 months. My total investment would be 12 lakhs. So in a normal SIP, my monthly investment commitment won’t change.

However, in a Step-Up or Top-Up SIP, the SIP amount increases automatically at a pre-defined rate or amount and at a specific period as mentioned by the investor while starting an SIP. For example, a person who is investing 10k every month via SIP can opt for a ‘Step-Up Plan’ by asking the fund house to increase his SIP amount by 10% every year (increase by a specific rate) or by Rs. 1,000/- each year (increase by a specific amount). This helps the investor to increase their investments along with an increase in their income and also helps in building up huger corpus.

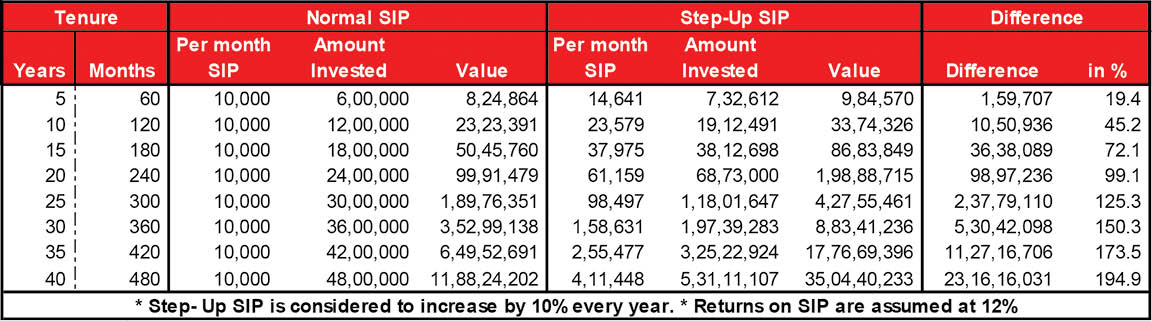

Here’s an understanding of the earnings-difference between a regular SIP and a Step-Up SIP.

(Refer Table)

The below table represents SIP Investment per month, total Invested Value and Final Value across time frames of 5, 10, 15, 20, 25, 30, 35 and 40 years in both the Normal SIP mode and Step-Up option. The starting monthly SIP amount considered is 10k each month and Step–Up is considered to be at 10% each year. So if the investor starts a new SIP of Rs.10,000/- this year with a Step-Up option, next year his SIP amount will increase to Rs.11,000/- i.e. (10% of 10,000 = 1,000, so total SIP is 11,000) and in the third year 12,100 (i.e. 10% of 11,000 = 1,100, so total SIP is 12,100) and so on.

Hence if we do a normal SIP for 30 years our investment would be 36 lakhs and the corpus accumulated would be 3.52 crores. Similarly in a Step-Up SIP, by just increasing our investment by 10% every year, we would be investing around 1.58 lakhs each month and in the 30th year, our total investment then would be 1.97 crores and the corpus accumulated by then would be 8.83 crores! We will end up with 5.3 crores or 150% more corpus after a span of 30 years. In fact, you will double your corpus in just 20 years of Step-Up SIP tenure!

Hence if we do a normal SIP for 30 years our investment would be 36 lakhs and the corpus accumulated would be 3.52 crores. Similarly in a Step-Up SIP, by just increasing our investment by 10% every year, we would be investing around 1.58 lakhs each month and in the 30th year, our total investment then would be 1.97 crores and the corpus accumulated by then would be 8.83 crores! We will end up with 5.3 crores or 150% more corpus after a span of 30 years. In fact, you will double your corpus in just 20 years of Step-Up SIP tenure!

A Step-Up SIP is most appropriate for those who are just doing a normal SIP and can easily increase their monthly saving commitment on an annual basis. Almost all of my clients call me on an annual basis requesting me to increase their SIP by a certain rate. This will ensure most of their financial goals like their retirement, children Navjote and higher education can be met with ease. If you don’t wish to continue increasing your SIP commitment regularly, you will have to cancel it and begin a new SIP. In case you have an SIP in demat mode contact your financial adviser or DP who will help you to increase your SIP as and when you want.

- દિકરી એટલે બીજી માં… - 20 April2024

- નાગપુરની બાઈ હીરાબાઈ એમ. મુલાનદરેમહેરનો ઇતિહાસ - 20 April2024

- વિશ્વ ભારતી સંસ્થાન દ્વારા રતિ વાડિયાનુંસન્માન કરવામાં આવ્યું - 20 April2024