Khushroo B. Panthaky, is a Chartered Accountant and a Senior Partner with 40 years of professional experience in an Accounting and Audit firm.

In pursuit of the ‘Viksit Bharat’ initiative, the Union Budget 2024 primarily focuses on employment, skilling, MSMEs and the middle-class. Hon’ble Finance Minister announced a review of the existing Income Tax Act with an aim of simplification, reduction in tax disputes and increase in tax certainty.

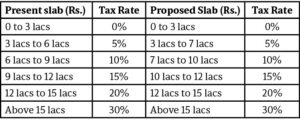

CHANGES IN NEW TAX REGIME:

The budget has proposed changes to the tax structure for individual taxpayers, offering the potential to save up to Rs.17,500 annually:

The proposed slabs could save taxes up to Rs.10,000. It is proposed to increase standard deduction from Rs.50,000 to Rs.75,000, which could further increase tax saving by upto Rs.7,500 for the salaried. These changes would positively impact a wide range of taxpayers.

The proposed slabs could save taxes up to Rs.10,000. It is proposed to increase standard deduction from Rs.50,000 to Rs.75,000, which could further increase tax saving by upto Rs.7,500 for the salaried. These changes would positively impact a wide range of taxpayers.

Rationalisation Of Capital Gains Provisions

Presently, Capital Gains provisions are complex with different holding periods for different classes of assets and multiple rates of taxes. To rationalise the capital gains provisions, the following is proposed effective 23rd July, 2024:

- There would be only two holding periods – 12 months and 24 months, for determining whether the capital gain is short-term or long-term. 12 months shall be applicable in case of listed securities, units of equity oriented mutual funds and units of business trust. 24 months shall apply to unlisted assets, gold, immovable property etc.

- The applicable tax rate on short-term capital gains earned from certain assets like listed equity shares, listed equity oriented mutual funds etc. would increase from 15% to 20%. All other short-term capital gains shall continue to be taxed at the applicable slab rate.

- A uniform tax rate of 12.5% is proposed for all long-term assets. This means that the tax rate on listed equity shares, equity oriented mutual funds etc. would increase from 10% to 12.5%. However, the tax rate on immovable property, gold etc. would reduce from 20% to 12.5%. It is important to note that indexation benefit shall also not be available for any long-term assets, which means that the upward inflationary adjustment in the cost of asset would no longer be available, resulting in a higher taxable capital gain.

- The exemption limit for long-term gains on Securities Transaction Tax (STT) paid on equity shares, units of equity-oriented fund and units of business trust is proposed to increase from Rs.1 lac to Rs.1.25 lac.

Increase In STT Rate On F&O Transactions

Presently, the STT rate on sale of option in securities is 0.0625% of the option premium, while STT for sale of a future in securities is 0.0125% of the price at which such ‘futures’ are traded. These are proposed to increase to 0.1% and 0.02%, respectively, effective 1st October, 2024, making F&O transactions costlier and could discourage low-income earners to trade in such transactions.

Increase In Contribution To National Pension Scheme (NPS)

It is proposed that employees opting for the new tax regime shall be eligible for higher deduction upto 14% of basic salary (increased from 10% under the existing provisions) for contribution made to NPS by the employer on employee’s behalf. However, it is to be noted that pursuant to the amendment made in 2020, contribution by the employer towards specified retirals i.e., Provident Fund, NPS and Superannuation Fund exceeding Rs. 7.5 lacs would be still taxed in the hands of the employees.

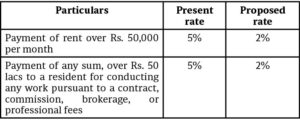

Changes In The Rates Of Tax Deducted At Source (TDS)

The budget has brought in amendments in the TDS rate for certain payments by individuals, a couple of which have been highlighted as under, which shall be applicable w.e.f. 1st October 2024:

Credit For Tax Collected At Source (TCS) And TDS

Credit For Tax Collected At Source (TCS) And TDS

The budget proposed a notable change by allowing the credit of TCS and TDS against TDS on salaries. This means that the employers can now consider TCS and TDS (on income other than salaries) when calculating and deducting TDS on salaries. By incorporating TCS credits, employees will benefit from potentially lower TDS deductions and increased cash inflow, easing their financial burden.

TCS Of Minors

Presently, there’s no provision for allowing credit of TCS of a minor to any individual (including Parent) other than the collectee. Addressing this, the proposal suggests that the credit of a minor’s TCS should be allowed to a parent, provided the minor’s income is also clubbed with the parent’s income.

TCS On Purchase Of Luxury Goods

Presently, TCS of 1% is applicable on purchase of motor vehicle of value exceeding Rs.10 lacs. It is proposed to extend the applicability of TCS to luxury goods (exceeding INR 10 lacs) as notified by the Central Government w.e.f. 1 January 2025.

Penalty For Non-Disclosure Of Assets And Income Under BMA

Presently, failure to furnish return by a resident assessee having foreign asset(s) or failure to disclose details of foreign income and assets in the tax return attracts a penalty of Rs.10 lacs under the Black Money Act, except in respect of one or more bank accounts where aggregate balance does not exceed Rs. 5 lacs at any time during the previous year.

W.e.f. 1st October, 2024, it is proposed to extend this exception to all asset or assets (other than immovable property) where the aggregate value of such asset or assets does not exceed Rs.20 lacs.

To conclude, this is a mixed feel budget which brings a blend of advantages and challenges for the individual taxpayers. While some may benefit from reduced tax liabilities and new deductions, others might face increased tax outflows on account of changes in capital gains tax rates, STT, absence of indexation benefit, etc. It is important for taxpayers to thoroughly understand the new provisions (which are subject to receiving Hon’ble President’s assent) and assess their individual situations to ensure an effective tax planning.

- સુરતની માતા-પુત્રી મહારૂખ ચિચગર અને મહાઝરીન વરિયાવાનું દુર્લભ અરંગેત્રમ - 18 January2025

- પવિત્ર શેહરેવર મહિનાની ઉજવણી - 18 January2025

- બસ્તર ગામમાં પેસ્તનજી ખરાસનુંસન્માન કરતું સ્મારક - 18 January2025