We all wish to get rich/richer. But, unless one has the mythical Midas Touch to get rich, one has to follow the 3 P’s – Planning, Prudence and Patience. However busy you may be in your professional/personal engagements, you must invest some time – in estimating your income and expenses, both present and future, your financial commitments like loan repayments etc – and devise an intelligent plan to reshape your existing investment allocation. It may seem overwhelming, given the scores of confusing terminologies used, or the hundreds of product advertisements you’re bombarded with, but, an independent financial adviser with multi-product knowledge can be of help. Today’s article is intended to guide you towards alleviating the common fear that equities are risky.

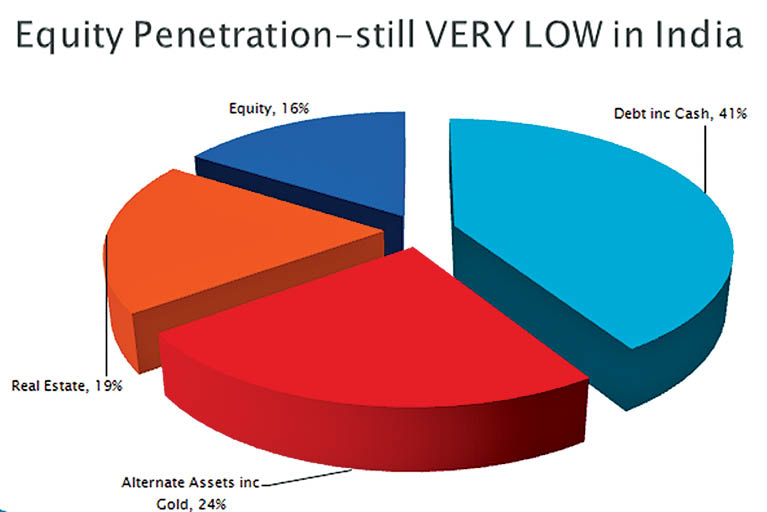

Planning: First, we need to understand that various investment options can be broadly classified as Equity (eg. Shares, mutual funds, ULIPs, ETFs) and Debt (PPF, FDs, NSC, Debt Mutual funds, bonds etc). The basic difference between the two is the risk-reward ratio, i.e. while Equity may seem more risky in the short-term, it is the only asset class, even when compared with Debt, gold or real estate, that can help your wealth grow substantially over the long term. Depending on your goals, risk appetite, and holding period, allocate your savings broadly into Equity and Debt instruments to start with.

Planning: First, we need to understand that various investment options can be broadly classified as Equity (eg. Shares, mutual funds, ULIPs, ETFs) and Debt (PPF, FDs, NSC, Debt Mutual funds, bonds etc). The basic difference between the two is the risk-reward ratio, i.e. while Equity may seem more risky in the short-term, it is the only asset class, even when compared with Debt, gold or real estate, that can help your wealth grow substantially over the long term. Depending on your goals, risk appetite, and holding period, allocate your savings broadly into Equity and Debt instruments to start with.

Prudence: Once you’re decided on the broad allocation, take help from a financial advisor who can suggest a good mix of equity funds, children’s education plans, ULIPs, retirement plans, debt funds, etc. Remember not to chase any unusually high returns without understanding the risks involved. Also ask him to explain clearly tax implications and the lock-in period for each product. Once you go through this process of educated investing, your portfolio will give you higher returns in a well planned manner, versus risking your hard earned money on random ‘tips’ or hearsay, especially from persons who may be well-intentioned, but not qualified to guide you.

Be aware that unless your adviser is registered with SEBI as an ‘Investment Adviser’, under the SEBI (Investment Advisers) Regulations 2013, he is not qualified to advise you.

Patience: Being a conservative, long-term investor myself, the following are a few investment guidelines for you:

- Equity is the only asset, globally, which over the long-term beats inflation.

- You need to have a 3 to 5 year horizon, and hence park only that amount in lump-sum or systematically, which you don’t need for that period.

- Markets are very sensitive to short-term news-flow and can rise or fall sharply. Do not panic, stay calm (invested).

- Don’t make the mistake that even a veteran like Jim Rogers did last year by selling his holdings in India, and later regretting it via his own open letter in the press. India is the fastest growing economy in the world with a young population, even when compared to developed nations. It represents one of the largest market opportunities, over the next many decades, as incomes and wealth are seen to grow exponentially. Global corporations are pumping billions of dollars into India, which is today the #1 FDI recipient globally, even ahead of China.

- High economic growth leads to higher corporate profits, thus long-term rise in the value of their equity shares. Hence, do not miss participating in this wonderful long-term growth opportunity which your own country provides. Diversify from low-yielding old-age instruments, especially deposits, gold bonds, or illiquid assets like commercial property into a whole host of new-generation products, which would help protect/grow your wealth in a more intelligent and wholesome manner.

- Consider this reality: if you invest for 1 or 2 years in an FD which gives post-tax return of 5-6% versus equity which may yield even 10-12%, the difference in earning is negligible. But if you invest for a period of 10 to 15 years, the difference is actually MORE THAN 100%!!

- તમારી જાત પર વિશ્વાસ રાખો અને લડ્યા વગર હાર ન માનવી જોઈએ, સકારાત્મક વિચારસરણી દરેક સમસ્યાને દૂર કરી શકે છે - 23 November2024

- સંજાણ ડેની 104માં વરસની ઉજવણી - 23 November2024

- 2024 ઈરાનશાહ ઉદવાડા ઉત્સવ આવી ગયો! - 23 November2024