.

Many of my young clients are cheering the rate cut by RBI, as now they will have to pay lesser EMIs on their auto and housing loans. Most of the corporate clients will reduce their debt burden as the interest outgo will reduce substantially. But there are some who are not at all happy with this rate cut.

The other day I got a call from 65-year old Rustomji Panthaki, sounding worried and agitated. Being a retired senior citizen, he wasn’t happy with frequent rate cuts by RBI as these tend to decrease his investments earning power. His SBI Fixed deposit made five years back when he retired at 60, matured today. The rate of Interest offered on this SBI FD then, was 9.5% for senior citizen, today the bank is willing to renew it at 7.25%. That’s a 2.25% less every year for next five years. To others it may seem like a meagre 2.25% but for Rustomji it’s a 25% reduction in his monthly income!

The other day I got a call from 65-year old Rustomji Panthaki, sounding worried and agitated. Being a retired senior citizen, he wasn’t happy with frequent rate cuts by RBI as these tend to decrease his investments earning power. His SBI Fixed deposit made five years back when he retired at 60, matured today. The rate of Interest offered on this SBI FD then, was 9.5% for senior citizen, today the bank is willing to renew it at 7.25%. That’s a 2.25% less every year for next five years. To others it may seem like a meagre 2.25% but for Rustomji it’s a 25% reduction in his monthly income!

Let’s say, Mr. Rustomji had Rs. 60,00,000/- FD with SBI @ 9.5% monthly interest payable. He used to get Rs. 42750/- after deducting 10% TDS every month in his savings account. Now when he renews this FD @ 7.25% he will get Rs. 32,625/- monthly. It especially hurts senior citizens who are not working and are solely dependent on investment income. We see that due to inflation the cost of living in a city continuously rises. What are the other options that Rustomji can look at?

According to India wealth report 2015 by Karvy private wealth, in India, the individual’s wealth in Equity Mutual Funds stood at Rs. 3.16L crores in FY 2015 as against Fixed Deposits which stood at an astounding Rs. 32.37L crores, and Bonds and Debentures which stood at Rs 0.89 Lakh crores in FY 2015. These figures testify that whenever we invest for a long term, FDs are our favourite option.

When I ask clients the reason behind investing in FDs, I broadly come across these reasons.

- Safety: it is assumed to have the highest safety than any other investment.

- Convenience: It’s the easiest thing to do. Walk in your nearest branch and they are more than willing to help you open a Term Deposit.

- Liquidity: we can get this money back in few hours.

- Returns: the returns are predict-able, at least for the term or tenure of the FD.

If you don’t want too much equity risk and volatility on your investments, bonds are another great option to invest your money. They are issued by banks, public sector entities and offer a fixed coupon rate for fixed tenure. They can be bought either at the time of issue or from the secondary market where they are traded after their issuance.

- Interest Income: they offer fixed coupon rates like FDs. Interest rates may differ depending upon the credit rating and tenure of a bond.

- Liquidity: premature withdrawal in fixed deposits attracts penalties, however in case of a bond it can be liquidated/sold in secondary market. The rate i.e. face value you get for this bond will be dependent on interest rate cycle. If the interest rates have gone down your bond is likely to fetch you a better price as it is inversely related to Interest rates.

- NO TDS: There will be no TDS if they are listed on exchanges and issued in demat mode. So there is no hassle of annual submission of form 15G or 15H unlike bank Fd’s.

- No paperwork: through your demat account you can buy bonds from primary or secondary market by few clicks on your laptop. What’s more, unlike your FD certificate you don’t have the tension to safeguard your bonds if they are in demat mode.

However investors needs to be cautious while buying bonds of different entities and should analyse their credit ratings from the rating agencies like CRISIL, ICRA etc. ratings like AAA, AAA+, AAA- , AA, BB, BBB, etc which represent the level of safety with regards to payments of principal and interest. Better the rating, lesser the risk! So always look for bonds with highest ratings.

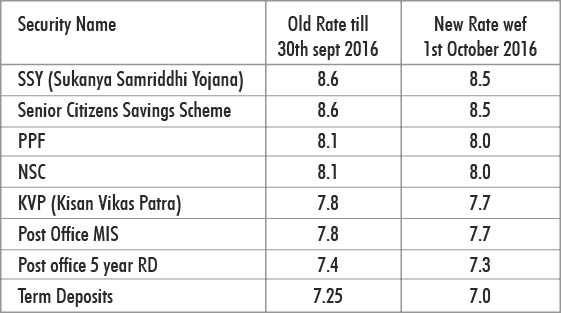

Interest rates are falling and are expected to fall further with easing of inflation and pick up in economy. Currently, the interest rates are in the 7- 8.5% range for a 5 year Fixed deposit. If you check the rates 15 years back they were in range of 11 to 13% and this trend is likely to continue.

So my advice to Rustomji is, if you are heading towards the bank for renewing your Fixed Deposit, change your direction towards Bond market or a Debt Mutual Fund. These securities have all the features of a Fixed Deposits with lesser taxation and more income.

- મા તે મા બીજા વગડાના વા - 11 May2024

- સુધારેલ એસ ડી મોદી પારસી ગર્લ્સ હોસ્ટેલ ફરી ખુલ્યું - 11 May2024

- શ્રીજી પાક ઈરાનશાહ આતશબેહરામની 1304મી સાલગ્રેહની ઉજવણી કરવામાં આવી - 11 May2024

People can invest in Listed secured bonds on NSE /BSE like SBI,M&M Finance,DHFL,Srei Infra,etc interest rate vary from 7.5%to 10%..one can buy perpetual bonds from whole sale debt mkt -eg IDBI bank @ 10% …